I’m super proud to have written this book. It’s the much improved second edition – and I can’t wait to hear what you think about it.

Please leave an Amazon review if you can – this really helps beat the algorithm, and is much appreciated!

A practical approach

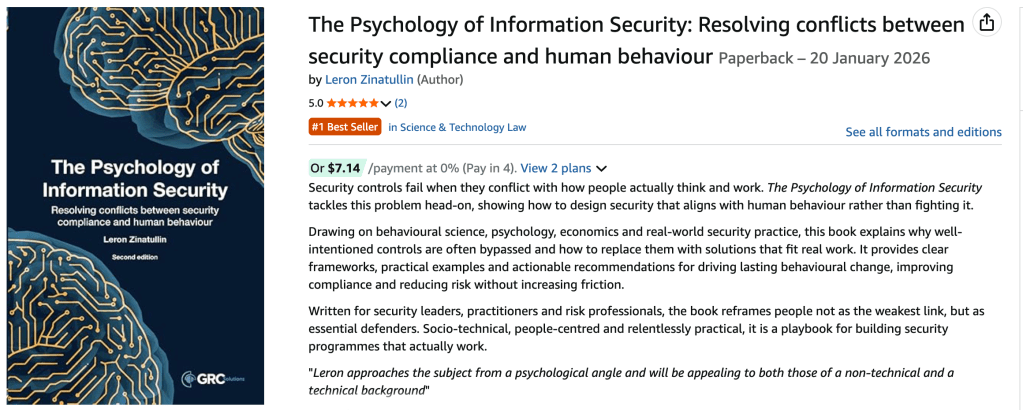

Excited that my book just hit #1 on Amazon’s bestseller list. Thank you to everyone who read, recommended, reviewed and supported this project – I couldn’t have done it without you. If you’ve read it, I’d love to hear what resonated most.

If you haven’t read it – it’s currently on offer in some Amazon stores, so get your 23% discount while you can!

And yes – it’s technically #1 in the very specific category, which is slightly amusing… I suspect it’s a hit with late-night cyber security enthusiasts rather than beach readers!

It was good to moderate a discussion on bridging the gap between strategy and execution. Great, candid conversation and plenty I’ll take back to the office.

Key takeaways:

☑️ Buy-in happens when you translate risk into business impact, work across functions and deliver early, visible wins.

☑️ Common pitfall: a glossy PowerPoint deck with no delivery plan. Convert vision into smaller, time-boxed outcomes with clear owners.

☑️ What makes the difference: realistic roadmaps, measurable OKRs (outcomes not activity), empowered teams and a steady governance cadence that removes blockers.

Thanks to the panelists and everyone in the audience who challenged orthodoxies – I learned as much as I hope I gave.

Thank you to everyone who stopped by the book signing. It was a pleasure to meet readers and hear your thoughts. If you missed it, you can still get the book on Amazon:

https://a.co/d/0fai5zyh

Security failures are rarely a technology problem alone. They’re socio-technical failures: mismatches between how controls are designed and how people actually work under pressure. If you want resilient organisations, start by redesigning security so it fits human cognition, incentives and workflows. Then measure and improve it.

Apply simple behavioural-science tools to reduce errors and increase adoption:

A reporting culture requires psychological safety.

Stop counting clicks and start tracking signals that show cultural change and risk reduction:

Always interpret in context: rising near-miss reports with falling latency can be positive (visibility improving). Review volume and type alongside latency before deciding.

If rate rises sharply with no matching incident reduction, validate whether confusion is driving questions (update docs) or whether new features need security approvals (streamline process).

An increase may signal stronger capability and perceived efficacy of security actions. While a decrease indicates skills gaps, tooling or access friction or perception that actions don’t lead to change.

Metrics should prompt decisions (e.g., simplify guidance if dwell time on key security pages is low, fund an automated patching project if mean time to remediate is unacceptable), not decorate slide decks.

Treat culture change like product development: hypothesis → experiment → measure → adjust. Run small pilots (one business unit, one workflow), measure impact on behaviour and operational outcomes, then scale the successful patterns.

When security becomes the way people naturally work, supported by defaults, fast safe paths and a culture that rewards reporting and improvement, it stops being an obstacle and becomes an enabler. That’s the real return on investment: fewer crises, faster recovery and the confidence to innovate securely.

If you’d like to learn more, check out the second edition of The Psychology of Information Security for more practical guidance on building a positive security culture.

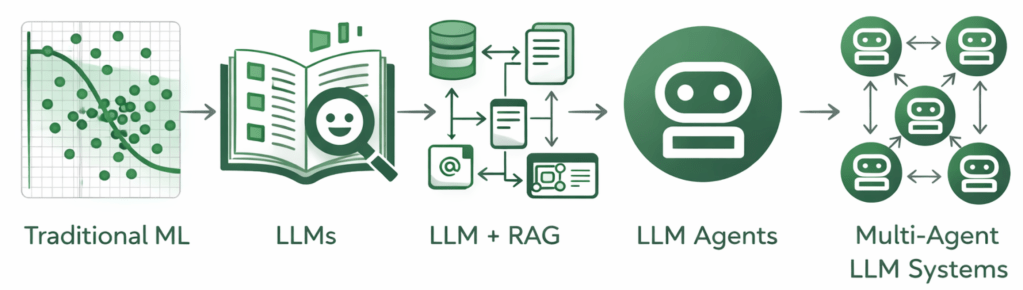

As AI adoption accelerates, leaders face the challenge of setting clear boundaries, not only around what AI should and shouldn’t do, but also around who holds responsibility for its oversight.

It was great to share my thoughts and answer audience questions during this panel discussion.

Governance must be cross-functional: security, risk, data and the business share accountability. I also reinforced the importance of guardrails, particularly forAgentic AI: automate low-risk work, but keep humans in the loop for decisions that affect safety, rights or reputation. Classify models and agents by impact and apply controls accordingly.

As organisations accelerate AI adoption, a familiar pattern is emerging: security teams – often the CISO – are increasingly asked to own or coordinate AI governance. That outcome is not an accident. Security leaders already operate across departmental boundaries, manage data inventories, run cross-functional programs and are trusted by executives and boards to solve hard, systemic problems. AI initiatives are inherently cross-disciplinary, data-centric and integrated into product and vendor ecosystems, so responsibility naturally flows toward teams that already do that work. This operational reality creates an opportunity: security can (and should) move from firefighting to shaping safe adoption practices that preserve value and reduce harm.

In this blog I outline key strategies on how to be successfully in leading AI governance initiatives in your organisation.

We are entering the agentic era – an inflection point defined by AI systems that can reason, plan and take action autonomously. This shift may be among the most consequential technological transformations of our generation, and it carries an equally significant obligation: to ensure these systems are designed, governed and deployed in ways that earn and sustain trust.

I completed a 5-Day AI Agents Intensive Course where we dove deep in Google’s open source Agent Development Toolkit. In this blog, I’ll share key takeaways and practical suggestions so you can navigate this shift and learn to build AI agents of your own.

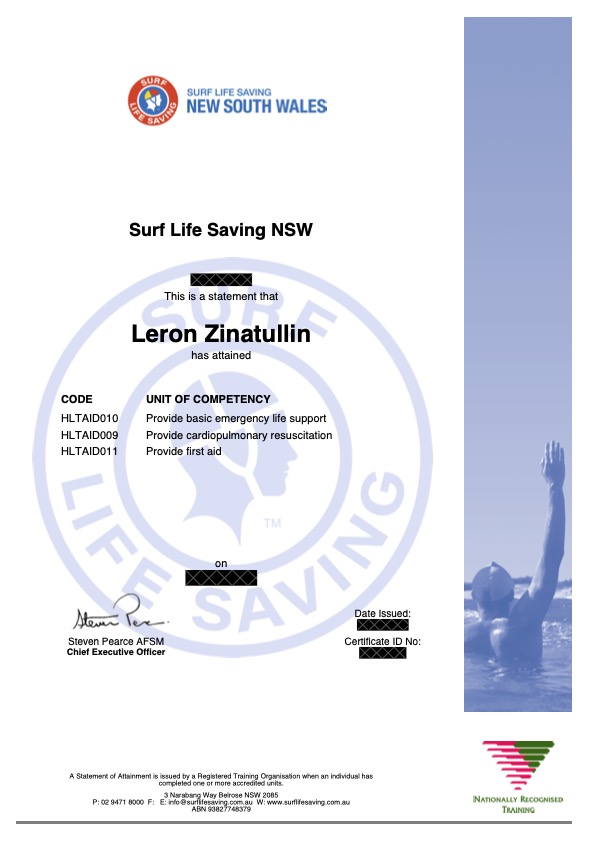

I recently qualified as surf lifesaver. Starting up as less than a confident ocean swimmer, this 8-week Bronze Medallion course definitely pushed me out of my comfort zone! I learned rescue techniques, first aid, resuscitation and how to operate in rough conditions.

Some lessons I learned apply to leadership and cyber security: practice beats theory, situational awareness matters, clear communication saves time (and sometimes lives) and simple tools often outperform complexity. Most of all, the course reinforced humility – competence grows through steady practice and teamwork.

Grateful for the experience and the reminder that fundamentals matter in any high-risk role. Stay safe!

I’m finishing the year having completed The Observership Program as a Board Observer with the Lokahi Foundation, an experience that provided valuable insight into board governance.

Alongside social impact and governance training from the Australian Institute of Company Directors, tailored to not-for-profit board directors, I spent twelve months observing a purpose-driven board and deepening my understanding of how decisions that matter are made.

Top takeaways:

• The art of questioning – how different types of questions shape discussion and drive clarity.

• Director responsibilities – the difference between reporting to a board and serving on one.

• Bringing stakeholders on a journey – effective communication, buy-in and sustained impact.

• Practical exposure to fundraising, strategy, marketing, sustainability and operations in the not-for-profit sector.

I had a chance to apply skills from my MBA and global corporate experience to support the board. I also drew on my domain expertise in cybersecurity, data protection, technology innovation, AI and impact measurement, particularly championing ethical data practices.

Thank you to the Lokahi Foundation board and the Observership Program for the opportunity to learn and give back. I’m excited to keep building these skills and to support future boardrooms.